Planning Application Fees Tax Deductible . In general, when acquiring or producing. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. this article discusses the tax consequences of transaction costs in four settings: the town and country planning (fees for applications, deemed applications, requests and site visits). These fees apply from 6 december 2023. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). a guide to fees for planning applications in england. Amendments up to the 6 december.

from www.financestrategists.com

Amendments up to the 6 december. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). In general, when acquiring or producing. this article discusses the tax consequences of transaction costs in four settings: irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. the town and country planning (fees for applications, deemed applications, requests and site visits). These fees apply from 6 december 2023. a guide to fees for planning applications in england.

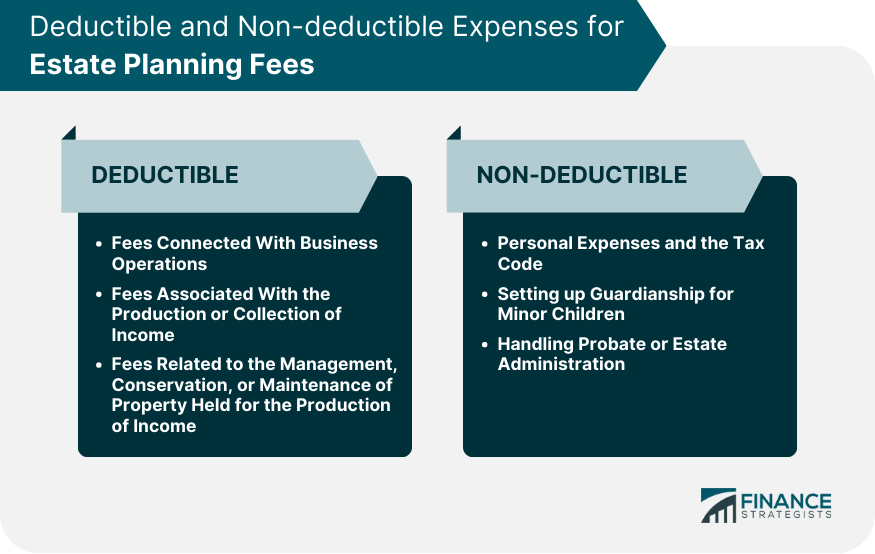

Are Estate Planning Fees TaxDeductible? Finance Strategists

Planning Application Fees Tax Deductible special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). These fees apply from 6 december 2023. a guide to fees for planning applications in england. this article discusses the tax consequences of transaction costs in four settings: the town and country planning (fees for applications, deemed applications, requests and site visits). they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). In general, when acquiring or producing. Amendments up to the 6 december.

From www.youtube.com

Are estate planning fees tax deductible in 2023? YouTube Planning Application Fees Tax Deductible Amendments up to the 6 december. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. the town and country planning (fees for applications, deemed applications, requests and site visits). In general, when acquiring or producing. a guide to fees for planning applications in england. These fees apply. Planning Application Fees Tax Deductible.

From www.pinterest.com

Maximize Your Savings Learn if Financial Planning Fees are Tax Planning Application Fees Tax Deductible a guide to fees for planning applications in england. In general, when acquiring or producing. These fees apply from 6 december 2023. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). the. Planning Application Fees Tax Deductible.

From changeofplan.com.au

Planning Application Fees Set to Rise Change of Plan Planning Application Fees Tax Deductible they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. Amendments up to the 6 december. These fees apply from 6 december 2023. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). a guide to fees for planning applications in england. this article discusses. Planning Application Fees Tax Deductible.

From www.financestrategists.com

Are Estate Planning Fees TaxDeductible? Finance Strategists Planning Application Fees Tax Deductible Amendments up to the 6 december. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. In general, when acquiring or producing. this article discusses the tax consequences of transaction costs in four settings: These fees apply from 6 december 2023. a guide to fees for planning applications in england.. Planning Application Fees Tax Deductible.

From investguiding.com

Investment Expenses What's Tax Deductible? (2024) Planning Application Fees Tax Deductible this article discusses the tax consequences of transaction costs in four settings: These fees apply from 6 december 2023. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. the town and country planning (fees for applications, deemed applications, requests and site visits). Amendments up to the 6. Planning Application Fees Tax Deductible.

From patch.com

Do You Know What DMV Fees Are Tax Deductible? Fair Oaks, CA Patch Planning Application Fees Tax Deductible special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). Amendments up to the 6 december. In general, when acquiring or producing. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. the town and country planning (fees for applications, deemed applications, requests and site visits).. Planning Application Fees Tax Deductible.

From www.clearestate.com

Are Estate Planning Fees Tax Deductible? Planning Application Fees Tax Deductible this article discusses the tax consequences of transaction costs in four settings: special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). These fees apply from 6 december 2023. the town and country planning (fees for applications, deemed applications, requests and site visits). Amendments up to the 6 december. a guide to. Planning Application Fees Tax Deductible.

From www.financestrategists.com

Are Estate Planning Fees TaxDeductible? Finance Strategists Planning Application Fees Tax Deductible These fees apply from 6 december 2023. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. the town and country planning (fees for applications, deemed applications, requests and site visits). a guide to fees for planning applications in england. Amendments up to the 6 december. special. Planning Application Fees Tax Deductible.

From falconexpenses.com

Are tax preparation fees deductible? Read to learn. Planning Application Fees Tax Deductible In general, when acquiring or producing. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. Amendments up to the 6 december. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. this article discusses the tax consequences of transaction costs. Planning Application Fees Tax Deductible.

From www.mcgannlawgroup.com

Are Legal Fees for Estate Planning Tax Deductible? Planning Application Fees Tax Deductible Amendments up to the 6 december. the town and country planning (fees for applications, deemed applications, requests and site visits). These fees apply from 6 december 2023. In general, when acquiring or producing. irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. a guide to fees for. Planning Application Fees Tax Deductible.

From www.sfplanning.co.uk

Planning Application Fees set to rise Planning Application Fees Tax Deductible Amendments up to the 6 december. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). These fees apply from 6 december 2023. In general, when acquiring or producing. the town and country planning (fees for. Planning Application Fees Tax Deductible.

From flyfin.tax

A SelfEmployed Guide To The Educator Expenses Tax Deduction Planning Application Fees Tax Deductible These fees apply from 6 december 2023. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). Amendments up to the 6 december. the town and country planning (fees for applications, deemed applications, requests and site visits). irs regulations outline several limitations on deductibility, so it is important to understand these limits and. Planning Application Fees Tax Deductible.

From napc.uk

Government planning application fee increase December 2023 NAPC Planning Application Fees Tax Deductible Amendments up to the 6 december. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. a guide to fees for planning applications in england. In general, when acquiring or producing. this article discusses the. Planning Application Fees Tax Deductible.

From www.planningdesign.co.uk

All rise Planning fee price increase Planning Design Ltd Planning Application Fees Tax Deductible Amendments up to the 6 december. this article discusses the tax consequences of transaction costs in four settings: a guide to fees for planning applications in england. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). In general, when acquiring or producing. irs regulations outline several limitations on deductibility, so it. Planning Application Fees Tax Deductible.

From www.youtube.com

How to find Tax Deductible Vehicle License Fee (VLF) _ stepbystep Planning Application Fees Tax Deductible Amendments up to the 6 december. this article discusses the tax consequences of transaction costs in four settings: In general, when acquiring or producing. a guide to fees for planning applications in england. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. These fees apply from 6 december 2023.. Planning Application Fees Tax Deductible.

From www.youtube.com

Do You Qualify For A Tax Deduction On Your Investment Management Fees Planning Application Fees Tax Deductible These fees apply from 6 december 2023. special rules and exceptions apply to certain transaction costs described as inherently facilitative (capitalizable). a guide to fees for planning applications in england. In general, when acquiring or producing. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. irs regulations outline. Planning Application Fees Tax Deductible.

From help.taxreliefcenter.org

Are Tax Preparation Fees Deductible? Tax Relief Center Planning Application Fees Tax Deductible they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. the town and country planning (fees for applications, deemed applications, requests and site visits). a guide to fees for planning applications in england. this article discusses the tax consequences of transaction costs in four settings: These fees apply from. Planning Application Fees Tax Deductible.

From exonxqbxo.blob.core.windows.net

Are Professional License Fees Tax Deductible at Jo Anderson blog Planning Application Fees Tax Deductible irs regulations outline several limitations on deductibility, so it is important to understand these limits and potential exceptions to. In general, when acquiring or producing. they incurred a lot of legal costs for the planning, design, survey, highway maintenance planning cost, etc. a guide to fees for planning applications in england. this article discusses the tax. Planning Application Fees Tax Deductible.